Bearish Engulfing Pattern: A Comprehensive Guide

A bearish engulfing candle is a powerful two-bar reversal pattern signaling a potential shift from up-trend to down-trend. When sellers overwhelm buyers with force, it often marks the start of a pullback or deeper decline. Below, learn its structure, psychology, trading tactics, and view a concrete example.

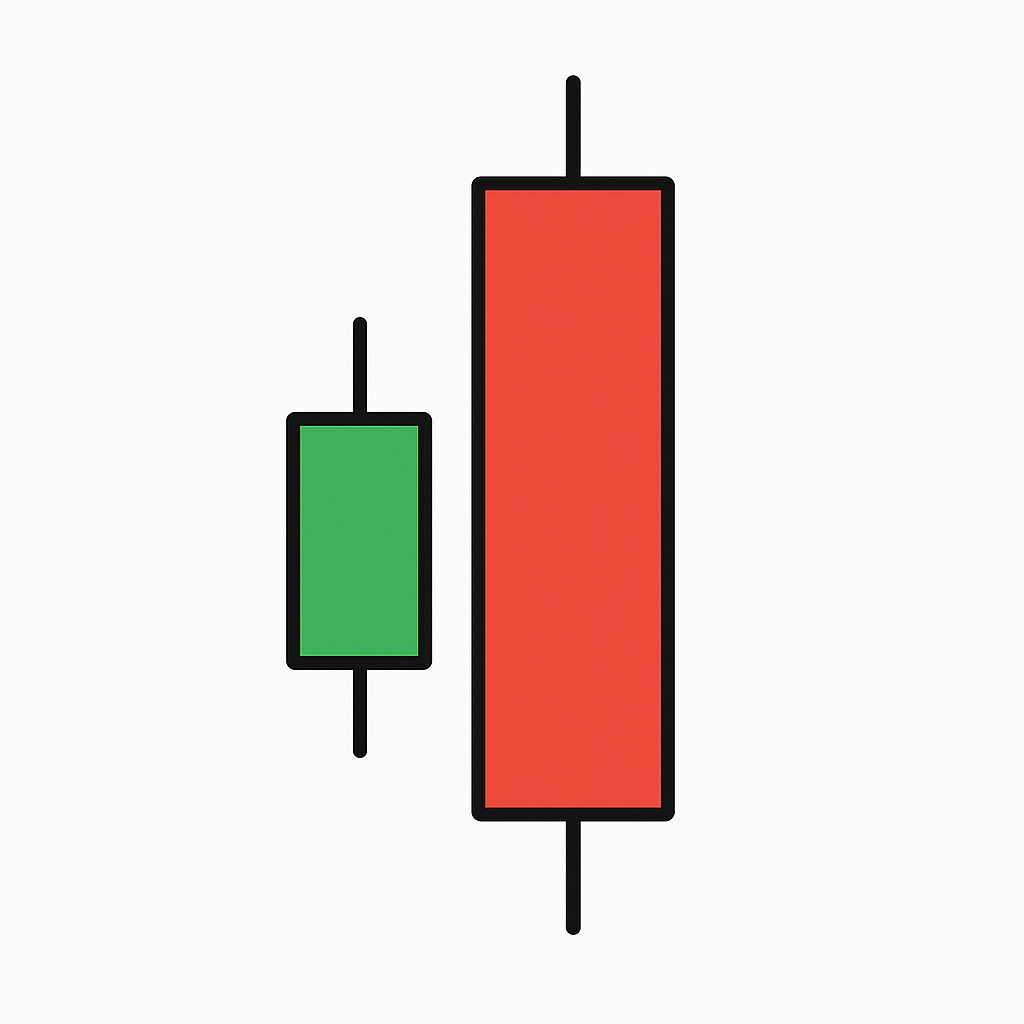

What Is a Bearish Engulfing Candle?

- Day 1: A bullish candle (close > open).

- Day 2: A bearish candle (close < open) whose real body completely “engulfs” Day 1’s body.

Psychology Behind the Pattern

- Day 1 (“Bull Day”): Buyers dominate, pushing price higher.

- Day 2 (“Bear Day”):

- Opens above Day 1’s close, showing initial bullish bias.

- Sellers then step in aggressively, driving price below Day 1’s open—trapping bulls and igniting bearish momentum.

Identification Criteria

- Trend Context: Appears after an up-trend or rally.

- Body Engulfment:

- Day 2’s body > Day 1’s body.

- Day 2 opens at/above Day 1’s close and closes at/below Day 1’s open.

- Volume Confirmation: A surge in volume on Day 2 strengthens the signal.

Trading Strategies

| Strategy | Entry | Stop-Loss | Profit Target |

|---|---|---|---|

| Conservative | Below Day 2 low | Above Day 2 high | Next support or 1:1 R:R |

| Moderate | Close of Day 2 | Midpoint of Day 1 & Day 2 bodies | 1.5–2:1 reward-to-risk |

| Aggressive | Market open of Day 3 (on break) | Above Day 2 high | Intraday swing lows |

Tip: Never risk more than 1–2% of your account on a single trade.

Real-World Example

Hypothetical Stock “XYZ”

| Day | Open | Close | Candle Type |

|---|---|---|---|

| Day 1 | 50 | 52 | Bullish |

| Day 2 | 52.5 | 49.5 | Bearish Engulfing |

Trade Setup:

• Entry: 49 (just below Day 2 low)

• Stop: 52.7 (just above Day 2 high)

• Target: 45 (next support), offering ~1.5:1 R:R

Tips for Better Success

- Ensure the pattern aligns with a higher-timeframe trend (e.g., daily engulfing within a weekly downtrend).

- Avoid sideways or choppy conditions to reduce false signals.

- Confirm with volume spikes on Day 2 for genuine selling pressure.

- Combine with overbought RSI readings or moving‐average resistance levels to filter entries.

Conclusion

The bearish engulfing pattern is a high-probability reversal signal when used in the right context. Mastering its recognition—alongside disciplined risk management and complementary indicators—can help you capitalize on trend reversals effectively. Trade safely and stay informed!